Affected by the rising operating rates due to the coming end of processing

subsidy policy of corn and the declining price of raw materials, China’s market price of corn starch slides down once again. It is predicted that the space for

corn starch demand to grow will be limited under the influences of the growing

number of competing products, the arrival of the slack sales season and the

passive export.

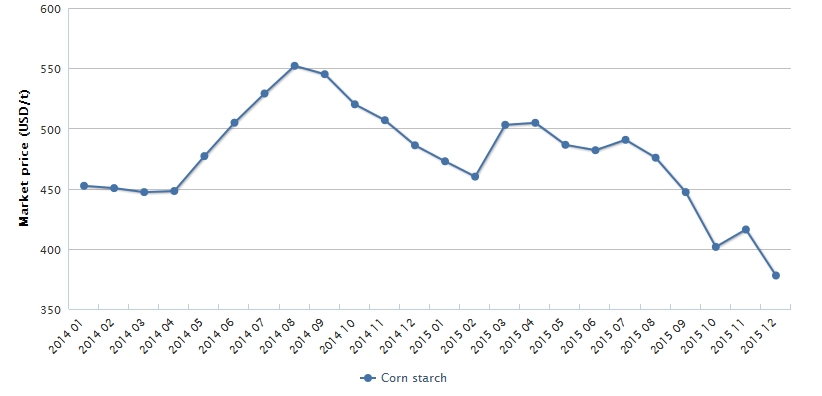

In Dec. 2015, China's market price of corn starch was back to a downturn after

a small rebound in Nov. 2015, and the decline was quite significant after

mid-to-late Dec. According to CCM research, on 15 Dec., 2015, the average

market price of corn starch in northern China was USD390.79/t (RMB2,500/t). But

by 25 Dec., the price has declined to USD359.53/t (RMB2,300/t), down by 8.00%

in just ten days. On a whole, the average price in Dec. was USD377.82/t

(RMB2,417/t), down 22.26% from the same period of 2014.

Actually, there are two blocks keeping the market price of corn starch from

recovery.

1. The subsidy policy on corn processing

comes to an end.

Jilin Province, one of China's major producers for corn starch no more

enjoyed the subsidy policy on deep processing after the day of 31 Dec. In order

to catch the last chance to enjoy the subsidy, many deep-processing enterprises

substantially improved their operating rates. In Dec. 2015, the operating rate

of deep-processing enterprises in Jilin was over 80%. The enhanced market

supply drove the price down.

Although industry insiders generally believed that there was great possibility

for Heilongjiang Province and Jilin to continue the

deep-processing subsidies in the general policy orientation to accelerate the

consumption of the corn inventory in 2016, manufacturers generally chose to

step up their production to fill up the inventory before the detailed amount

and the exact time of subsidy were officially released.

2. The market price of corn starch is

led by the price trend of raw materials.

The cost prediction is based on the average prices of related products in Dec.

2015.

The cost in producing

one tonne of corn starch = 1.4 tonnes of corn (USD297.01/t

- RMB1,900/t) + processing charges (USD85.97/t - RMB550/t) - the profits from

by-products (0.09 tonne of corn gulten meal that is priced at

USD604.94/t - RMB3,870/t, 0.04 tonne of corn oil that is priced at

USD1,485.00/t - RMB9,500/t and 0.35 tonne of corn germ meal that is priced

at USD125.05/t - RMB800/t).

In Dec., the average production cost of corn starch was USD344.16/t

(RMB2,201.70/t). When the profits from by-products haven't been considered, the

cost of corn is more than 85% related to the cost of corn starch.

As the weather got better and the supply of corn recovered to the normal level

in Dec., the corn price started to fall down again under the huge inventory

pressure. According to the data collected by CCM, China's market price of

corn in Dec. was USD297.01/t (RMB1,900/t), down 2.82% month on month.

Therefore, the corn starch price was dragged down by the raw material price.

As the price kept falling, the corn starch started to squeeze the market space

of other starch products, but it is predicted that the space for corn starch

demand to grow is limited.

The number of competing products is

boosted.

As Vietnam and Thailand, China’s two major cassava starch import origins are

busy in production from Nov. to Jan. of the following year, which will enhance

China’s import volume of cassava starch with dropping import price. It is forecasted

that the import volume in later period will keep growing. According to China

Customs, China imported 124,200 tonnes of cassava starch in Nov.

2015, up 25.20% month on month and the import price was USD421.00/t, down 4.97%

month on month.

The slack sales season is arriving.

After the Spring Festival, China will encounter the slack sales seasons of

starches, thus downstream manufacturers for food and starch sugar will not call

for too much inventory and purchases. Besides, when the subsidy policy is due,

the production cost of corn starch will go up and probably its sales price will

climb up, which is not good for the sales.

The export is passive.

The export tax rebate policy on corn starch (export rebate rate: 13%) ran out

in 2016. China’s competitiveness of corn starch in the international market

will weaken. Meanwhile, on 19 Dec., 2015, an agreement about the policy on

agricultural export competition was achieved at the Ministerial Conference of

the World Trade Organization just concluded in Nairobi, capital of Kenya - both

developed and developing countries will completely cancel the export subsidies

for agricultural produces.

These two policies will be unfavorably help China to export its corn

starch.

Average market price of corn starch in

northern China, Jan. 2014-Dec. 2015

Source: CCM

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta.

We will attend FIC in this week. If you would like to meet us for consultancy in FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.